We’ve all become used to a few key data points about ourselves determining our credit worthiness; our job, our salary, where we live. But lack of algorithmic transparency in the artificial intelligence (AI) used in financial services means that information as seemingly random as how often you drain your phone battery could now be used to decide whether you will be accepted for a loan.

AI in banking and financial services

The use of AI in banking and financial services has been accelerating in recent years, prompted in no small part by by the potential for significant savings in staff and overheads. A loan application AI can churn through thousands of applications in the time it takes a human loan officer to review just one – an extremely attractive prospect.

Potential cost savings from AI applications is estimated at $447 billion for banks by 2023, leaving financial services companies across the board scrambling to find new ways to incorporate the technology into their products and services.

Lack of algorithmic transparency

But the way in which many of these AI’s work, and the criteria they use for credit scoring isn’t transparent and in many cases isn’t fully understood even by the bank or organisation deploying the AI.

Chinese start-up Smart Finance uses thousands of data points to grant millions of small loans in just a few seconds of analysis. Applicants have to grant the application full access to their smartphone and the AI then assesses micro data points that would probably never have been considered important by a traditional loan officer including:

- how much battery is left in the mobile phone,

- the speed at which the users enter their date of birth,

- if they took enough time to read a user agreement, and even

- how often they order take-away food.

Smart Finance say this then builds a digital fingerprint of the prospective applicant that can be matched against previous loan customers to see if their profile matches those most likely to repay their loans. Customers who regularly let their phone batteries drop below 12% are not good prospects apparently.

The peculiar correlation between phone battery life and the % age likelihood of repaying a loan is something the algorithm has identified after analysing millions of data inputs and isn’t necessarily something that would make sense to a human observer. And because of the lack of algorithmic transparency, there may be many other data points that would make even less sense to us, even if they were revealed.

Singapore-based startup Lenddo for example is also using smartphone user data to score loan applications and says that at the opposite end of the scale to very low battery life, hyper well-maintained smartphone batteries also raise a red flag in their loan system, as they might indicate a user is too ‘robotic’ and ‘not human enough’.

Consumers are about to become even more confused by banks

If you had decided that keeping an eye on your phone battery might be a good idea for future credit worthiness, the revelation that there is a sweet point of battery use – but that no-one is about to tell you where it is – is an indication of just how frustrating and opaque our financial institutions might be about to become. If no-one within your bank really understands how their AI works and how it is scoring you there is very little chance that you will be able to argue against it or explain why its conclusions are misleading.

Welcome to the age of AI.

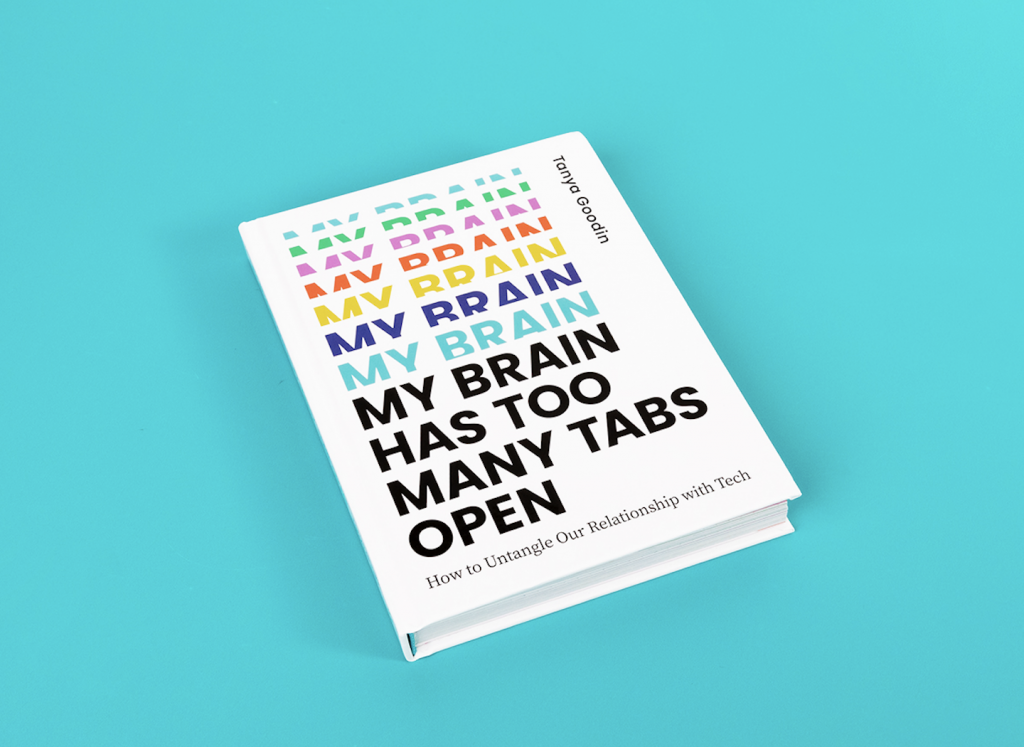

For more about how the lack of algorithmic transparency is changing our world – pick up a copy of my new book.